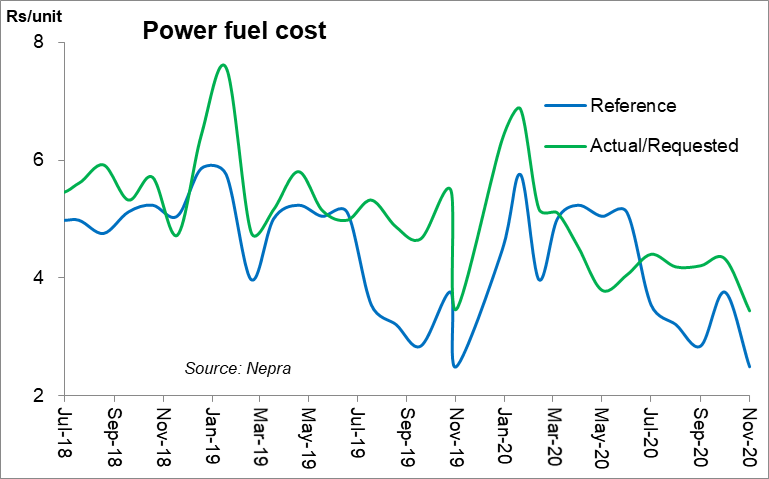

For the fifth month running in FY21, the monthly Fuel Cost Adjustment (FCA) allowed by the regulator has fallen short of what was requested by the Central Power Purchasing Agency (CPPA). On the surface, this totals to a disallowance of Rs15 billion in five months and may not look a great deal. But as is the case with most things in the power sector, there is more problem beneath the surface than on it.

The disallowance has by and large been on account of disregard to the Economic Merit Order as stipulated by the NTDC. While the power generation mix has visibly changed for the better over the last three years, thanks largely to the power plants conceived by the previous government, the same has not necessarily led to higher compliance in terms of merit order generation.

Case in point is 40 percent share of hydel generation in November 2020 which was referenced at 46 percent in tariffs, or 17 percent share of natural gas in October, when it was referenced at 18 percent. This is what has been going on for months, and while there is provision in the tariff mechanism for changes in actual fuel prices, much of the impact is instead forced by deviation from the referenced power generation mix – and little is due to changes in fuel base price.

Furnace oil-based power generation will make its way out as the winters take over, as evident from almost negligible FO based generation in November. The trend will likely continue till March, and then it will be back. It will be back not because of merit, but mostly because of the way the system has been built and run. There will be multiple excuses offered for the furnace oil to be back in the mix, of which the transmission constraints to cater and evacuate more power from the more efficient plants based on cheaper fuel sources, will be the first.

No less than Rs65 billion worth of FO has been burnt for power generation in the last 12 months, of which very little sits on merit. Nepra has time and again asked for adequate response from the CPPA and NPCC, which has been short of satisfactory. Mind you, even the adjusted allowance for all FO and HSD based generation is subject to adjustment based on the final outcome of the ongoing suo moto proceedings against RFO based IPPs. Winters will once again put this to the backburner, with another storm brewing, which could hit hard, should the court decision sway the other way.